Understanding the Rule of 72

Ever wondered how long it takes to double your money? The Rule of 72 is a handy shortcut to estimate this, without needing complicated calculations. It's a valuable tool for anyone wanting to better understand their investments or simply plan for their financial future. This guide will break down the Rule of 72, showing you how to use it and its limitations.

What is the Rule of 72?

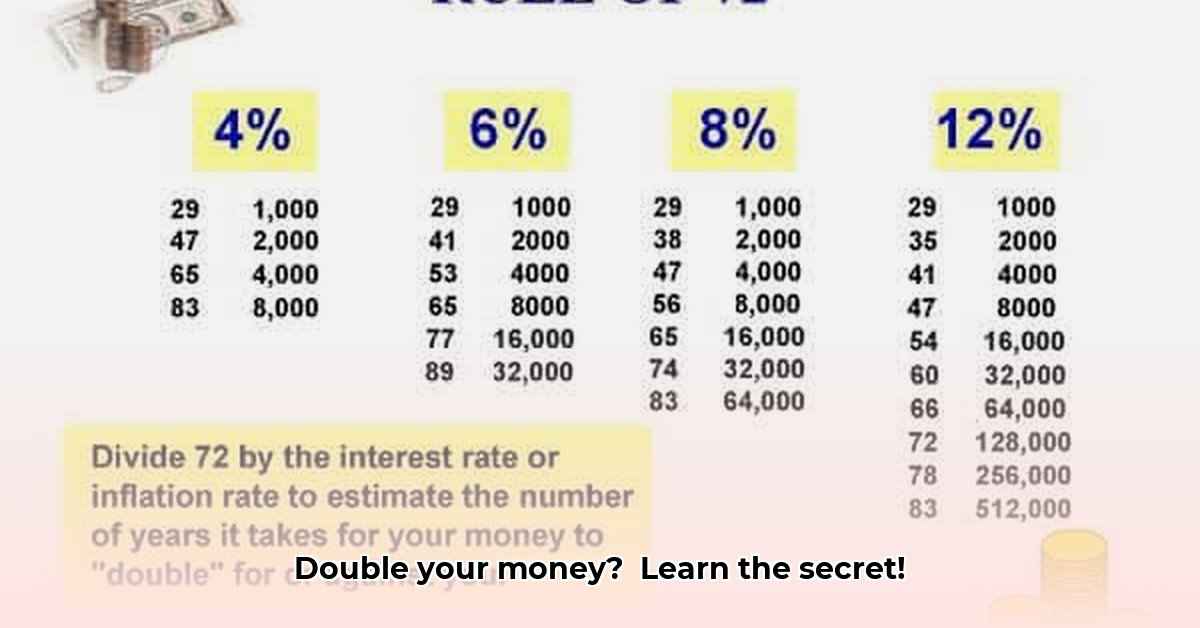

The Rule of 72 is a simple formula that estimates how many years it takes for an investment to double in value, given a fixed annual interest rate (or rate of return). To use it, you simply divide 72 by the annual interest rate. For example, if your investment earns 8% annually, it'll roughly double in 9 years (72 / 8 = 9). This is a great starting point, allowing for quick financial estimations.

How Does the Rule of 72 Work?

The magic behind the Rule of 72 is compound interest (interest earned not only on your initial investment, but also on accumulated interest). This creates a snowball effect, which gets bigger over time. The Rule of 72 provides a simplified way to understand this powerful effect without the heavy number-crunching. Want to see it in action? Let's look at an example.

A Real-Life Example: Investing Your Rands

Let's say you invest R10,000 at 10% annual interest. Applying the Rule of 72, it'll take approximately 7.2 years (72 / 10 = 7.2) for your investment to reach R20,000. Remember, this is an estimate, not a precise calculation.

Beyond Investments: Inflation and the Rule of 72

The Rule of 72 isn't only for investments; it's also useful for understanding inflation (the increase in the general price level of goods and services in an economy). If inflation is running at 4%, your money will roughly lose half its value in 18 years (72 / 4 = 18). This highlights the importance of planning for inflation when saving for future goals.

When is the Rule of 72 Most Accurate?

The Rule of 72 provides the most accurate estimates for annual interest rates between 6% and 10%. Outside of this range, the estimate becomes less precise. For higher or lower rates, a slight adjustment might be needed (we'll cover this later). However, even a slightly less precise estimate can still be extremely helpful for a quick financial overview.

Limitations of the Rule of 72: What to Keep in Mind

While incredibly useful, the Rule of 72 has limitations:

- It's an estimate: It doesn't account for fluctuating interest rates, taxes, or fees.

- Simple calculation: It assumes a constant interest rate throughout the investment period.

- General guideline: For highly accurate results, a more sophisticated financial model is needed.

However, its simplicity makes it a powerful tool for a rapid understanding of long-term financial growth.

Step-by-Step Guide to Using the Rule of 72

Here's how to use the Rule of 72 effectively:

- Determine your annual return: Find the percentage your investment is expected to grow each year.

- Divide 72 by the percentage: This will give you an approximate number of years to double your money.

- Consider adjustments (if necessary): For rates significantly above or below 6-10%, a slight alteration to the number 72 may improve accuracy.

- Interpret the result: The answer shows roughly how long it'll take to double your initial amount.

Adjusting the Rule of 72 for Higher Interest Rates

For interest rates above 10%, the number 72 may slightly overestimate the doubling time. A simple adjustment is to use a smaller number:

- 10-20% interest: Use 70 instead of 72.

- Above 20% interest: Use 69 or consider using a more precise compound interest calculator.

This adjustment offers a further refined estimate, which is especially important when dealing with higher rates of return.

Key Takeaways: Mastering the Rule of 72

- The Rule of 72 is a quick and easy way to estimate the doubling time of your investment.

- It works best for interest rates between 6% and 10%.

- Adjustments can be made for rates outside this range.

- Applying this rule empowers you to have a better grasp of your financial planning.

Remember, while the Rule of 72 is a valuable tool, it's always advisable to seek financial advice for major investment decisions, rather than relying solely on this estimation method.